Market failure and government intervention

The power of markets

- A market serves society by creating value through trade:

- Markets use prices to communicate the wants and limits of a diffuse and diverse society so as to bring about coordinated and economic decisions efficiently.

- When a market succeeds in creating value through trade, economists call this market efficiency:

- When it is possible to trade goods and services such that at least one person is better off and no one else is worse off.

Pareto optimality

- Pareto efficiency - the inability to reallocate resources without making at least one person worse off.

- A gain by one or more persons without anyone else suffering is known as a Pareto improvement.

- Pareto efficiency does not however imply equality or fairness.

- A relevant quote by Amartya Sen suggest that a society or an economy can be Pareto optimal and still be perfectly disgusting from an ethical perspective.

- Example: A small village where a rich dude has 90% of all the wealth in the society. Redistribution would not be Pareto efficient, even though it could be considered fairer.

- A relevant quote by Amartya Sen suggest that a society or an economy can be Pareto optimal and still be perfectly disgusting from an ethical perspective.

Inefficiency applied to markets…

- A market is inefficient when trading could make one person better off without making the other worse off.

- When markets fail to set prices that incorporate all social costs and benefits, the resulting allocation is not Pareto efficient.

If these do not hold… MARKET FAILURE

- Markets exist for all good and services produced and consumed.

- No market for clean air f.ex.

- All markets are perfectly competitive.

- But monopolies exist (ex. Apple).

- All transactors have perfect information.

- In the case of used cars, the seller knows more than the buyer f.ex.

- Private property rights are fully assigned in all resources and commodities.

- Tragedy of the commons.

- No externalities exist.

- All goods and services are private goods.

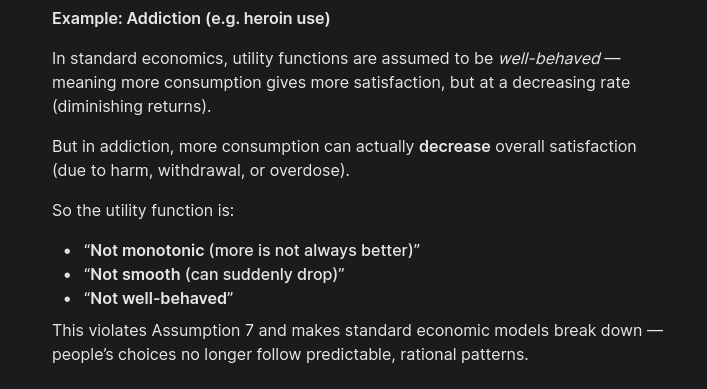

- All utility and production functions are well behaved.

- All agents are maximisers of utility.

Market failure

Simplistic market economic models don’t take into account unemployment, coordination problems, etc.

In economics, a market failure exists when the production or use of goods and services by the market is not efficient (Pareto inferior).

In economics, a market failure exists when the production or use of goods and services by the market is not efficient (Pareto inferior).

Causes of market failure

Market failure can arise due to any (or all) of the following:

- Externalities.

- Type of market structure.

- Lack of (or weak) property rights.

- Public goods and/or common property characteristics.

Externalities

An externality is an effect that is external to the causing agent (i.e., the person causes an effect that impacts on other people). An externality is said to exist when the utility of an economic agent is affected by the actions of another. Externalities can be negative or positive→

- A negative externality occurs when the affect person suffers a loss in utility that is uncompensated.

- Examples: air, water and noise pollution, biodiversity loss etc.

- A positive externality occurs when the effect is beneficial to the affected person:

- Examples: immunisation, technological development etc.

Causes

A number of factors give rise to externalities:

- Interdependence between economic agents: the activity of one or more agent affects utility or the production function of another.

- Moreover, the market system often fails to price this interdependence, meaning that the affected party is not compensated.

- Difficult to trace externalities.

- Other reasons mentioned below.

- Lack or weak property rights: without firm property rights, the affected party is unable to demand that the externality be reduced or ask for compensation.

- High transaction costs: the costs of negotiating, implementing and enforcing an agreement between the parties may be high. If the affected agent is compensated for their loss of welfare, the externality is internalised, and society is better.

Type of market structure

Under monopolistic market competition structures:

- The monopolist will sell goods at a higher price than would firms under perfect competition. Under monopsonistic market competition structures:

- The monopsonist will buy goods at a lower price than would firms under perfect competition.

Lack of (or weak) property rights

- Property rights are important for successful markets.

- These can be formal or informal.

- Well defined property rights represent a set of entitlements that define the owner s privileges and obligations for use of a resource or asset.

Characteristics

Property rights have the following characteristics:

- Comprehensive: resources are privately or collectively owned,with all entitlements defined, well known and enforced.

- Exclusive: all benefits and costs from the resource accrue to the owner.

- Transferable: property rights should be transferable from one owner to another through voluntary exchange.

- Secure: property rights should be secure from involuntary seizure or encroachment by other people, firms, and the government.

Natural resources

- Property rights over natural resources are often difficult to define and enforce.

- With non-enforceable property rights, the natural resource cannot be used optimally as the owner is unable to prevent the access to the resource to third parties.

- The use or the extraction path of the resource is unlikely to be optimal in free markets.

- Too much extraction/harvesting occur →unsustainable outcome. There are different types of property rights regimes that we can distinguish introducing these two concepts:

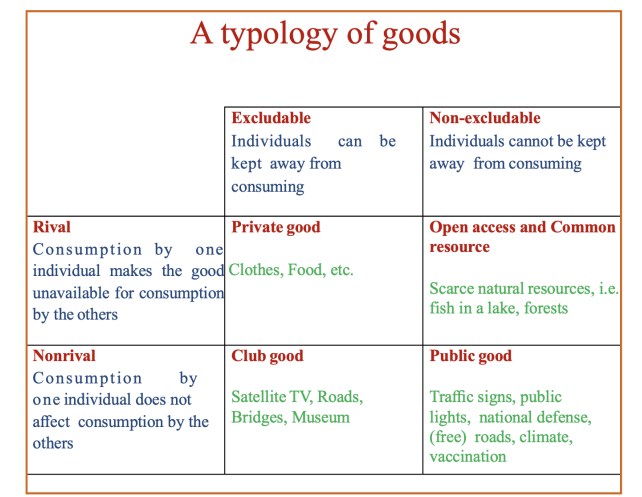

- Nonexcludable goods: consumers cannot be prevented from consuming the good.

- Nonrival goods: One individual’s consumption of the good does not diminish other consumers’ enjoyment of the same good.

Private goods

Private goods are comprehensive, exclusive, transferable and secure:

- Comprehensive no grey areas in ownership.

- Exclusive two people/parties don’t both get it.

- Transferable you can sell or trade it.

- Secure it can’t be taken without it being theft.

- A private good is rival in consumption (i.e., once someone consumes the good, another person cannot consume it).

Congestion good or club good

- Congestion goods are exclusive in consumption and can be either non rival or rival in consumption.

- They do not fit neatly into either private or public goods.

- They exhibit the characteristics of public goods at low levels of consumption, whereas at higher levels of consumption they exhibit the characteristics of private goods.

- A walking trail is an example.

- With a small number of walkers, peoples’ enjoyment is not reduced, but after a certain congestion threshold people s enjoyment is reduced.

- Other examples include: roads, bridges, museums, fishing sites, historic sites etc.

Public goods

- A public good is a good that is nonexcludable and nonrival:

- Nonexcludable: No one can be prevented from using the good.

- Nonrival: One person’s consumption does not reduce availability for others.

- Example: Clean Air, Biodiversity, Climate Stability→

- Non-excludable: No one can be excluded from breathing clean air.

- Non-rivalrous: One person breathing clean air doesn’t reduce its availability for others.

- Most environmental goods fall under the category of open access/common property goods or pure public goods In such cases lack of well-defined property rights results in market failure.

- Resulting in inefficient allocation of resources.

Open access/common property goods

- The goods are rival in consumption, non-exclusive, non-transferable, and often non-enforceable.

- Typical example of open access goods is ocean fisheries, or forests.

- Common property goods (e.g., common grazing land) are rival in consumption and are exclusive for a group of people (e.g., a group of farmers).

- This can lead to a tragedy of the commons.

Tragedy of the commons

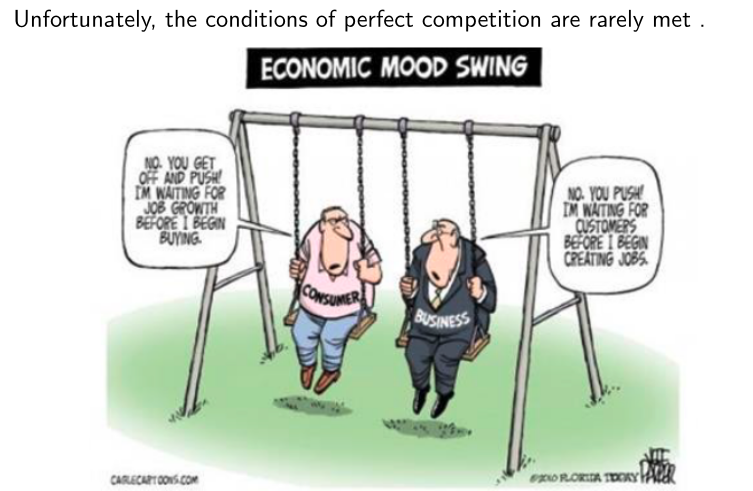

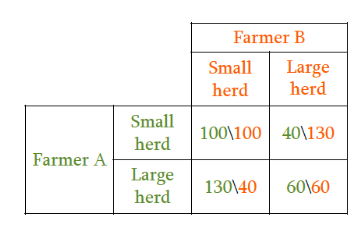

Hardin (1968), The tragedy of the commons, Science. Imagine, two herdsmen have access to common land:

- The utility of the herdsmen has one positive and one negative component:

-

- Additional profits from one more animal that are fully private

-

- Additional overgrazing costs: if one or both the farmers increase their herd, the land will be degraded and support fewer livestock.

-

- What should be the best strategy to get the highest profit?

- The farmers’ choices related to the number of cows that they put on the common grazing land determine the share of profits that are made from milk sales.

- Numbers in the table defines farmers’ profits.

- A nash equilibrium would be created in cell 60/60, but wouldn’t be pareto efficient.

- Clearly, the positive component is greater than the negative one so each herdsman will add one animal to his herd.

- The outcome will be overgrazing and soil erosion of communal pastures ⇒unsustainable use of the resource In the words of Hardin, each man is locked into a system that compels him to increase his herd without limit-in a world that is limited.

- However, the best outcome would be Small herd but needs cooperation.

- Overgrazing can be also seen as an example of congestion externality leading to an unsustainable use of the resource component:

- Congestion externalities: my use of a resource imposes an additional cost to other’s or reduce the benefits of others that also use this resource.

- Threshold effects: Grazing by one herder increases the cost of grazing by other herders only if there are too many herders for the carrying capacity of the land.

- Carrying capacity: the maximal population (of plants, animals or humans) that an ecosystem can support without environmental degradation.

Examples of Tragedy of the Commons

- Climate change and GHG emissions.

- Exponential population growth.

- Overfishing.

- Mismanaged waste into the ocean.

Property rights regimes

Government intervention

Assignment of well defined property rights:

- Setting price of social damage through taxation (Pigovian or green taxation) such that the price set is equal to the external cost or marginal damage suffered by the environment.

- Setting the quantity of social damages through tradable pollution permit systems (cap and trade).

Market failure

- Much of governmental activity is allegedly justified on the grounds of economic (Pareto) efficiency.

- Pigou in his Economics of Welfare first popularised the idea that the existence of (externalities) is grounds for government intervention , which would take the form of a subsidy to the activity generating positive externalities and taxes to the activity generating negative externalities.

- Government intervention may seek to correct for the distortions created by market failure and to improve the efficiency in the way that markets operate:

- Pollution taxes to correct for externalities.

- Taxation of monopoly profits.

- Regulation of oligopolies/cartel behaviour.

- Direct provision of public goods (e.g., health care, social welfare and defence).

- Policies to introduce competition into markets (de regulation).

- Price controls for the recently privatised utilities.